Dump Trucks Market Introduction and Overview

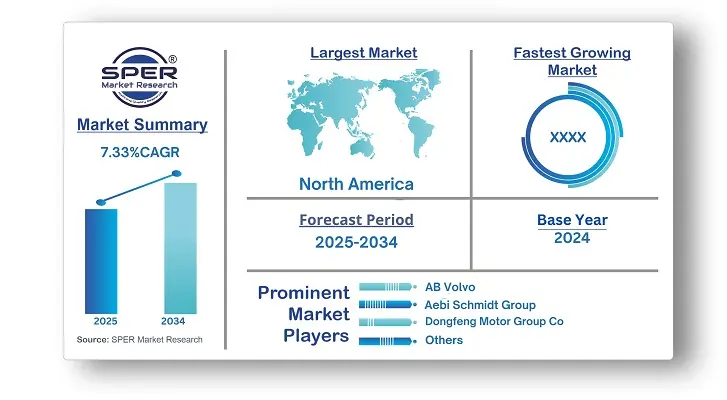

According to SPER Market Research, the Global Dump Trucks Market is estimated to reach USD 136.77 billion by 2034 with a CAGR of 7.33%.

The report includes an in-depth analysis of the Global Dump Trucks Market, including market size and trends, product mix, Applications, and supplier analysis. The market for dump trucks was estimated to be worth USD 67.42 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.33% between 2025 and 2034. Some of the key growth drivers for this market include the rapid rise of the construction industry, increased use in the mining industry, adoption of current technologies in manufacturing processes, and technological advancements in product features such as engines and capacities.

By Engine Insights

In 2024, the ICE (Diesel/Gasoline) segment led the global market with the highest revenue share. ICE vehicles are commonly used in many sectors for transporting large amounts of materials, including construction, mining, waste management, and road development. The growth of this segment is due to diverse operational needs, payload capacity, challenging terrains, and a rising demand for efficient transport in construction.

From 2025 to 2034, the electric engines segment is projected to grow the fastest. This growth is driven by a focus on sustainability, demand for zero-emission products, efforts to cut carbon footprints, and heightened awareness of climate change. Improved availability and modern technology integration also support this segment's expansion.

By Type Insights

The rear dump trucks segment held the largest revenue share of the global market in 2024 due to their wide use in construction, infrastructure development, mining, and transport. Continuous urbanization has driven the rise in new constructions. Recent infrastructure projects in China and India have reached new highs, increasing the demand for transporting materials like sand and demolition waste.

The side dump trucks segment is expected to grow the fastest during the forecast period because of their better capabilities, ease of use in tough terrains, and growing use in activities like site preparations and excavations. They are particularly useful for quickly unloading materials in road work.

By End-User Insights

The construction sector led the global dump trucks market in 2024 due to the increased use of these vehicles for efficient transport and timely handling of essential materials like sand, stones, and metals. The demand for housing in urban areas, smart commercial developments, industrial growth in some countries, and infrastructure projects in developing economies are projected to boost this segment's growth in the coming years.

Regional Insights

Asia Pacific dominates the dump truck market globally, holding the largest revenue share in 2024. This is due to increased mining and construction activities, infrastructure development in countries like India and China, rising demand for decarbonization solutions like electrification of dump trucks, and regulatory changes.

North America is expected to grow the fastest from 2025 to 2034. The mining of various resources and the need for sustainable transportation solutions, such as electric dump trucks, will drive market growth in the construction sector.

Market Competitive Landscape

Sany Group, Caterpillar Inc., and Deere & Company dominate the dump truck industry. Several major variables contribute to this strong presence. To begin with, these companies have vast experience and skill in heavy machinery manufacture, which has earned them confidence and credibility among consumers all over the world. Second, their dedication to innovation guarantees that its dump trucks are outfitted with innovative features that provide improved performance, efficiency, and longevity. Furthermore, their global distribution networks and comprehensive after-sales service help them maintain their market dominance and cement their positions as industry leaders.

Recent Developments:

In July 2024, Cummins Inc., technology developer Komatsu, and Vale announced a partnership to produce huge trucks with a payload capacity of 230 to 290 tonnes that are fuelled by diesel and ethanol with an emphasis on lowering carbon emissions.

In June 2024, XCMG Machinery, a leading company in the construction machinery market, launched a new hydrogen fuel cell dump truck, EHSL552F. It features a high-power battery system and a 120kW hydrogen fuel cell, aimed at helping mining industry users reduce daily carbon emissions.

Scope of the report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Engine, By Type, By End User |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa |

| Companies Covered | AB Volvo, Aebi Schmidt Group, SANY, FAW Trucks Qingdao Automobile Co., Ltd, China National Heavy Duty Truck Group Co., Ltd, Daimler Truck AG, Dongfeng Motor Group Co., Ltd, Heil, Caterpillar, Deere & Company, Magirus.

|

Key Topics Covered in the Report

- Global Dump Trucks Market Size (FY’2021-FY’2034)

- Overview of Global Dump Trucks Market

- Segmentation of Global Dump Trucks Market By Engine (ICE, Electric)

- Segmentation of Global Dump Trucks Market By Type (Rear, Side, Roll-off)

- Segmentation of Global Dump Trucks Market By End-User (Mining, Construction, Others)

- Statistical Snap of Global Dump Trucks Market

- Expansion Analysis of Global Dump Trucks Market

- Problems and Obstacles in Global Dump Trucks Market

- Competitive Landscape in the Global Dump Trucks Market

- Details on Current Investment in Global Dump Trucks Market

- Competitive Analysis of Global Dump Trucks Market

- Prominent Players in the Global Dump Trucks Market

- SWOT Analysis of Global Dump Trucks Market

- Global Dump Trucks Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPER’s internal database

2.1.4. Premium insight from KOL’s

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTER’s Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Dump Trucks Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Dump Trucks Market

7. Global Dump Trucks Market, By Engine (USD Million) 2021-2034

7.1. ICE (Diesel/Gasoline)

7.2. Electric

8. Global Dump Trucks Market, By Type (USD Million) 2021-2034

8.1. Rear

8.2. Side

8.3. Roll-Off

9. Global Dump Trucks Market, By End-User (USD Million) 2021-2034

9.1. Construction

9.2. Mining

9.3. Others

10. Global Dump Trucks Market, (USD Million) 2021-2034

10.1. Global Dump Trucks Market Size and Market Share

11. Global Dump Trucks Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. AB Volvo

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Aebi Schmidt Group

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. SANY

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. FAW Trucks Qingdao Automobile Co., Ltd

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. China National Heavy Duty Truck Group Co., Ltd

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Daimler Truck AG

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Dongfeng Motor Group Co., Ltd

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Heil

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Caterpillar

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Deere & Company

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Magirus

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.